Shopping App: updated advanced Tax Management settings

Written by Marie Pireddu on

If you have a GoodBarber Shopping App, you already know that until now, you could set up your tax rates for countries that were parts of your shipping zones.

Thanks to your feedback, we have now added advanced settings allowing you to manage your tax rates by products and per region in addition to the global country rate.

Indeed, Tax rules vary depending on countries and are often broken down in a different set of rules depending on regions or states within a given country.

Different taxes will also apply to different products.

With the advanced settings, you can now configure your taxes very precisely.

Note: If your shop is located in the US or Canada, this does not apply. Taxes are already managed accurately by TaxJar. This new option is for our clients located in the rest of the world and more specifically Europe.

Thanks to your feedback, we have now added advanced settings allowing you to manage your tax rates by products and per region in addition to the global country rate.

Indeed, Tax rules vary depending on countries and are often broken down in a different set of rules depending on regions or states within a given country.

Different taxes will also apply to different products.

With the advanced settings, you can now configure your taxes very precisely.

Note: If your shop is located in the US or Canada, this does not apply. Taxes are already managed accurately by TaxJar. This new option is for our clients located in the rest of the world and more specifically Europe.

How does it work?

We'll go over the 2 different settings:

- How to set a tax rate per region in addition to the global country rate.

- How to set up your tax rate by product

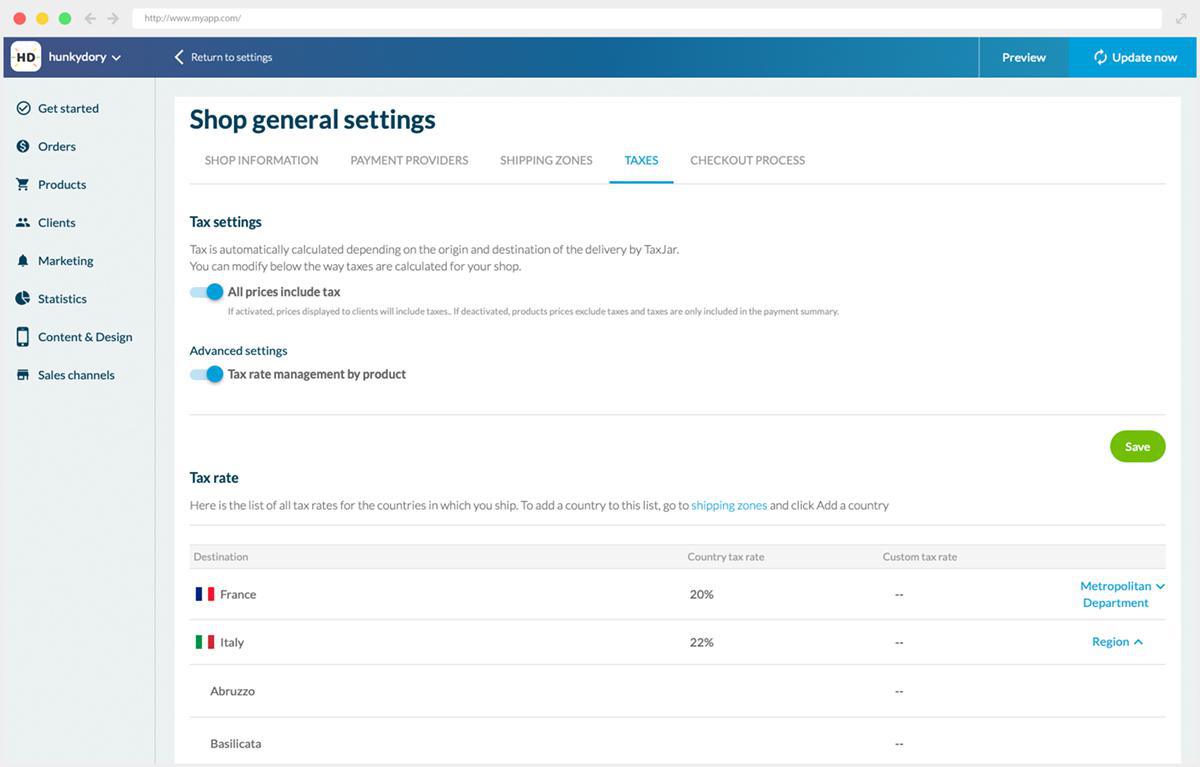

1. Tax rate per region

In the menu Settings > Shop Settings > Taxes, you will now see a dropdown menu for (almost) every country displaying their regions, provinces, prefectures, etc. For example, as you can see below, for Italy, you are now able to customize your tax for each of the regions.

This custom rate will then be applied to all your products.

This custom rate will then be applied to all your products.

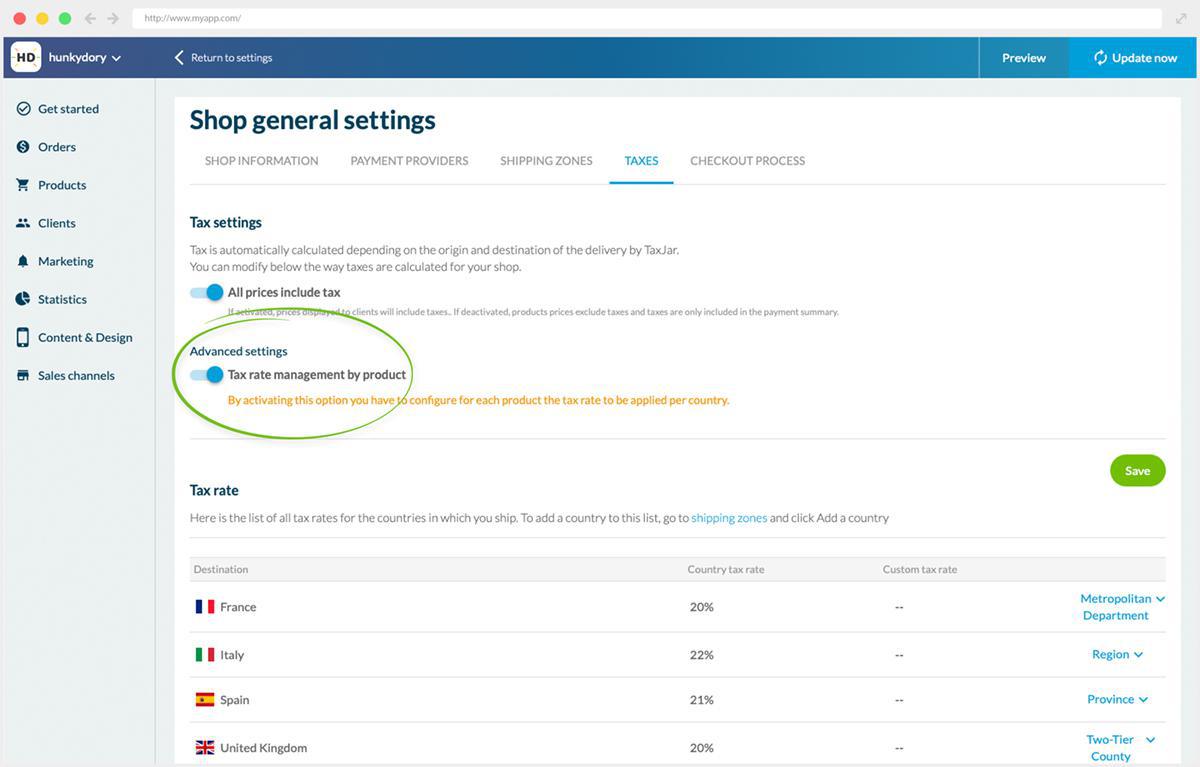

The second option is to activate the advanced setting: Tax management per product.

Once this is activated, you will instead be setting up your tax on each product page.

Let's see how this works.

2. Tax rate per product

You can activate this option in the menu Settings > Shop Settings > Taxes.

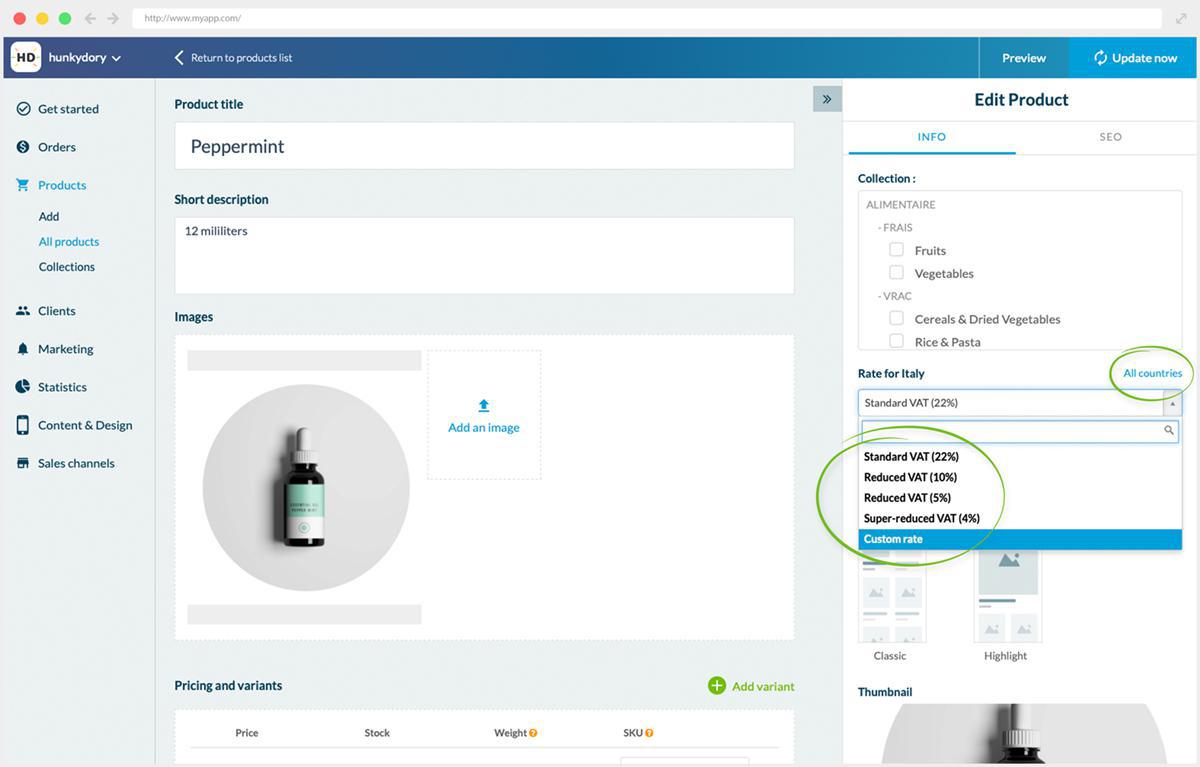

When you create a product (or edit an existing product) you'll see a new field in the "Edit product" menu, on the right-hand side. A dropdown menu will let you select a VAT rate (Standard, reduced, or super-reduced) according to the country where your shop is located.

When you create a product (or edit an existing product) you'll see a new field in the "Edit product" menu, on the right-hand side. A dropdown menu will let you select a VAT rate (Standard, reduced, or super-reduced) according to the country where your shop is located.

For example, if your shop is located in:

- France, you will have a dropdown menu with a 20% rate, 10%, 5%, 2.1%, or a custom rate option.

- Italy: then the available rates are 22%, 10%, 5%, 4% or a custom rate option

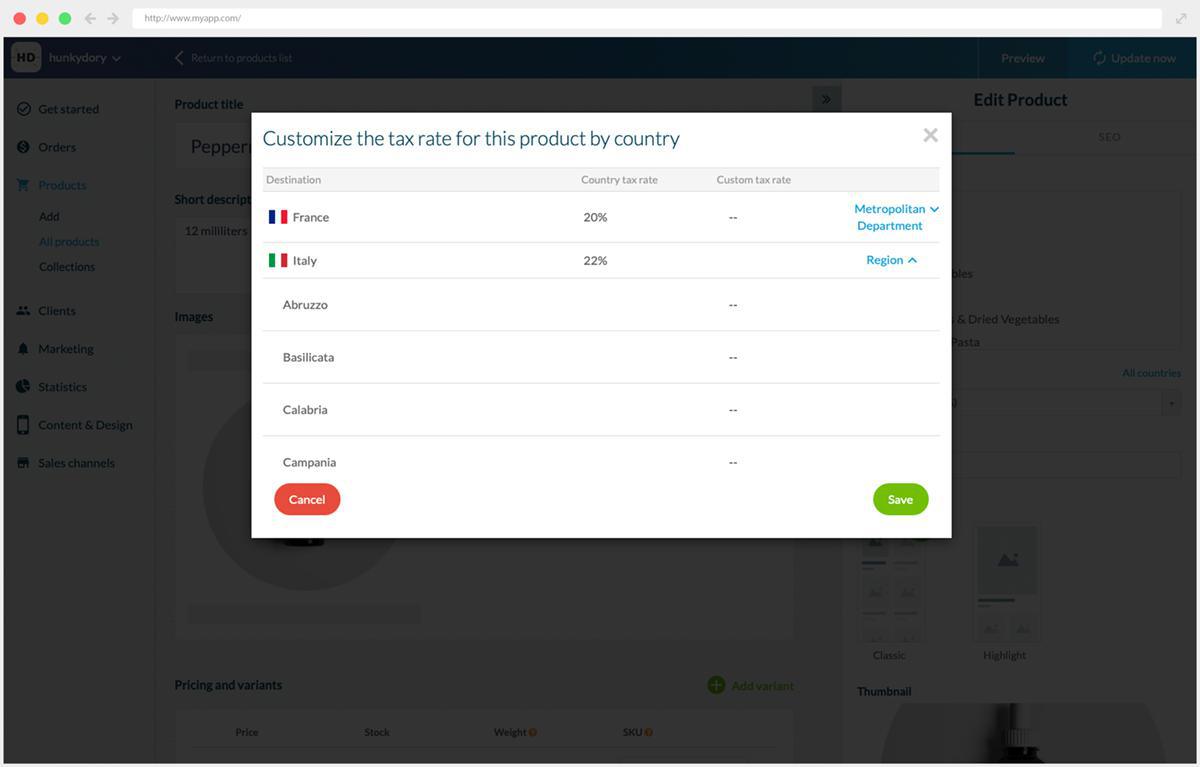

As we said previously, you can now also manage taxes not only by country but also by region, provinces, or other admin sub-divisions. . When you activate the option of tax management per product, the breakdown of tax per these sub-divisions will be done directly on the product page by clicking on the " All countries" link in the "Edit product" menu.

For example, you can set the rate for wine bottles at X% in one region and X % in another region, and this for each country that is part of your shipping zones. While you can set another set of tax rates for let's say your water bottles. You can configure your tax rates as precisely as needed.

For example, you can set the rate for wine bottles at X% in one region and X % in another region, and this for each country that is part of your shipping zones. While you can set another set of tax rates for let's say your water bottles. You can configure your tax rates as precisely as needed.

It’s important to get in touch with your state’s or country's taxing authority or an experienced accounting professional should you have questions about sales tax

Design

Design