GoodBarber's Online Help

Setting up taxes for my shop

The regulations concerning merchant taxes are complex and subject to frequent changes, they also and above all depend on your delivery areas, more precisely on your international sales. Taxes are calculated based on the origin (your address) and the destination of the shipment (your customer's address).

By default we use Taxjar, which is particularly suitable for the USA and Canada, particularly in terms of taxes between states.

You can also use your own Tax rates and disconnect Taxjar.

We advise you to always consult a tax accountant to verify that your applied tax rates are correct. GoodBarber does not collect or remit any tax for you. You are responsible for processing sales taxes based on your settings.

Note: To access the tax management, you must first fill in the address of your shop as well as the delivery zones because the taxes depend on these 2 elements.

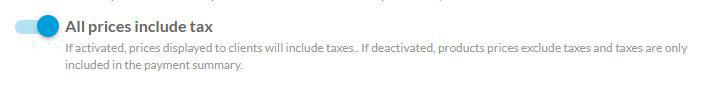

Display of prices without tax or all taxes included

You can include or not, the taxes in your selling prices. For this go to the menu Settings > Taxes.

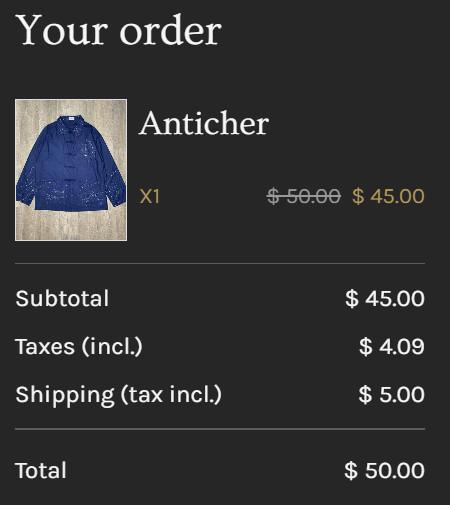

- If the option is enabled, prices displayed to your customers will be displayed with all taxes included.

$45,00 Inc VAT $4,09 (10%) + $5,00 Shipping = $50.00

The detail of the shipping tax is displayed on the invoice.

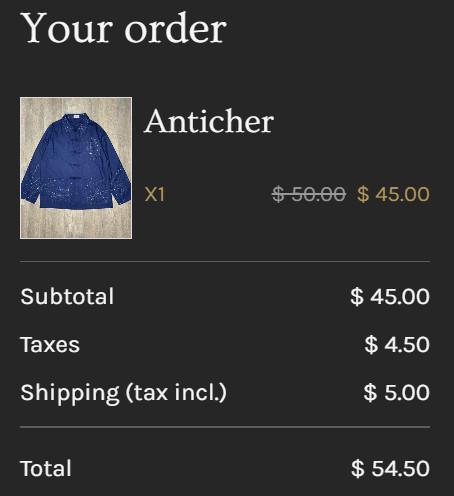

- If the option is disabled, product prices are displayed excluding tax and tax is included in the payment summary.

Exc VAT $45,00 + VAT $4,50 (10%) + $5,00 Shipping = $54.50

The shipping fee is displayed including taxes for greater readability, the detail of the tax is displayed on the invoice.

Taxes display

The taxes, strictly speaking, will only be displayed in the cart with the summary of the order, and more precisely when your customer has filled in his address (delivery or invoicing). Indeed, it is necessary to know the country to properly calculate the taxes.

If the customer has an account and is authenticated, the taxes will be displayed instantly.

Different tax rates and reduced rates

If your taxes are uniform, no problem, for example in a shoe store the rates do not differ.

On the other hand, if you sell products that have different tax rates (Ex: books at 4% and clothes at 20%), activate the option Tax rate management by product and read the online helps to find out how to apply a different tax rate per product .

Design

Design